Automated Crypto Trading

Making holding Bitcoin less painful, risky, and stressful using an algorithmic risk-managed first approach.

+92.17%

Supported exchanges

Protect and Grow

Our "risk-managed first, profit will follow" approach would have saved you 50% in February and November 2018 over holding. Check our backtests.

You Keep Control

You do not send us your crypto coins, money, or passwords. You keep full control over your own funds at all times.

No Settings

We believe in the performance of our 2 strategies. No tweaking/testing of settings needed. Check out strategies.

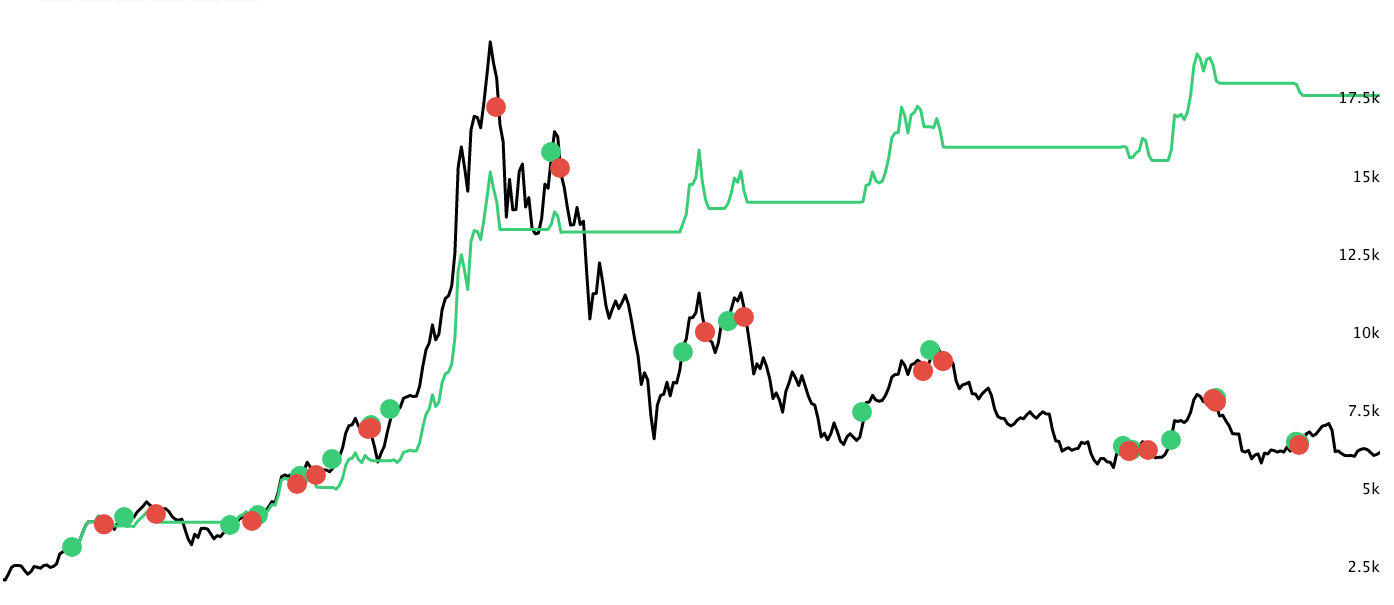

14 Month Performance. After Bull Run.

- CoinBakers 369.6%

Exposure 24.9%

- Bitcoin 187.9%

Exposure 100%

Results from 2017-07-15 · 2018-09-15.

All trades using GDAX/Coinbase Pro data running strategy JW_V4 V4.11.0.

Past performance does not predict future returns.

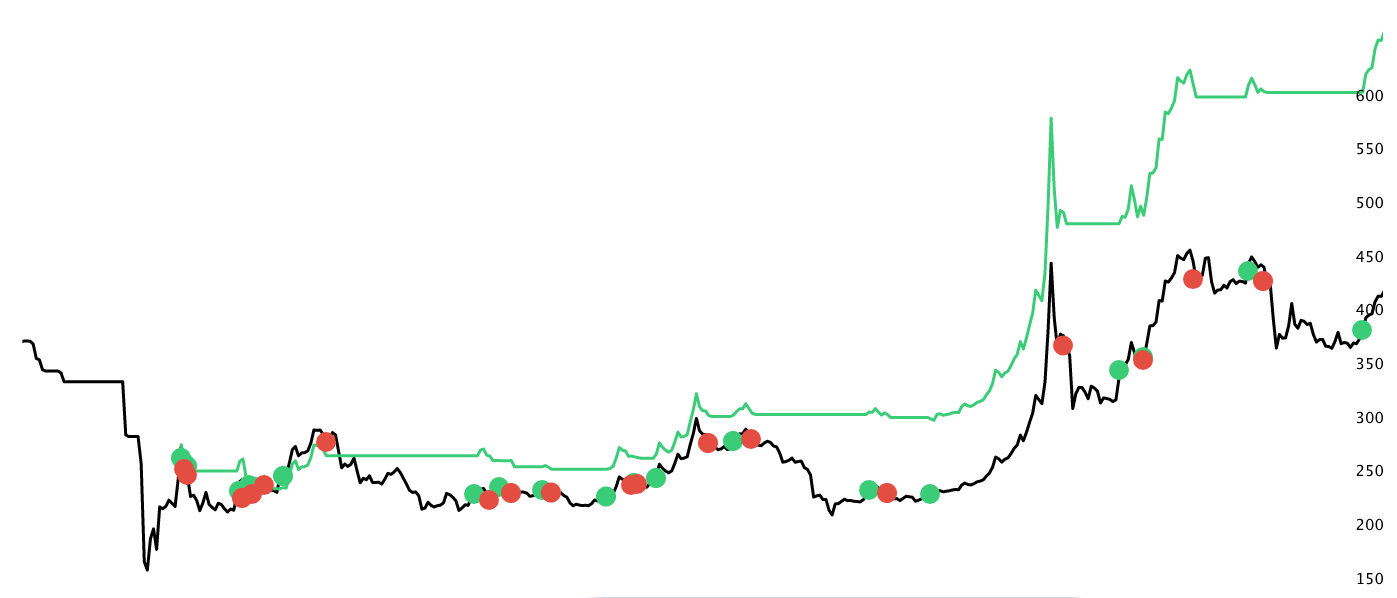

14 Month Performance. Before Bull Run.

- CoinBakers 117.6%

Exposure 39.6%

- Bitcoin 43.2%

Exposure 100%

Results from 2014-12-01 · 2016-02-20.

All trades using GDAX/Coinbase Pro data running strategy JW_V4 V4.11.0.

Past performance does not predict future returns.

Just a simple example.

If you bought and held Bitcoin on November 1st 2017 for $1,000 at a price of $6,425.01, you would have $980,39 on August 9th 2018. A loss of -1.96%.

If CoinBakers V4 would have managed this amount, your final balance would be $2,773.89. A profit of +177.39%.

Based on JW_V4 4.5.1 and 34 trades. Start time 2017-11-01 00:00:00 end time 2018-08-09 00:00:00. Based on start price 6425.01000 USD and end price 6299.00000 USD from CoinBase Pro API data. Past performance does not predict future returns.

Why Our Strategies Are Superior Over Hodling

Hodling through the period marked by 1 would have decimated 50% of your dollar value. Our exits marked by the red dots would have secured most of your investment. The vertical areas marked in red are bear trends, in which we refrain from trading, preserving your dollar value. All our strategies make use of a safe haven to protect your portfolio.

How does it work exactly?

Sign up and select a strategy that fits you best.

We host this strategy and apply its trades using API keys. We can not transfer your money out. Any time you can revoke permissions and see what trades are active in our dashboard or your exchange.

You can switch strategies on the fly, pause, and cancel any time. It's that simple.

Pricing

Hosted

$49/mo

- Managed hosting for a strategy of choice

- Fully managed automatic trading

- You keep full control over your own money, coins, and passwords. You never send this to us

- Quarterly performance report

- Support for CoinBase Pro and Binance

- Up to managing 10K USD, get in touch for bigger portfolio's

Which exchange do you support?

We support CoinBase Pro and Binance.Which pairs do you support?

BTC only in the currencies USD, EUR, GBP, USDT, and USDC. Read here why.What are the risks involved?

Theoretically you could lose all your money. Practically, it is designed to be less risky than if you just buy and hold. Simply because we exit the market once it turns down (in your sleep). We averagely have around 24% market exposure.Do I need to install software?

CoinBakers runs in the cloud and communicates directly with your exchange using the API keys you provide us. No software to install or to maintain.How does your strategy or algorithm work?

Find all the details and backtest results hereHow many trades do you do per month?

Between 1 and 4. Sometimes none if we are in a long down market or sideways market. Updates on strategies might change trade frequencies. Check our changelog.Can I trade myself while using your service?

Not recommended but possible. You can deposit/withdraw anytime though and it will automatically picked up for your next trades.The logo, is that a croissant?

It sure is!- Check out our FAQ for more questions and answers.